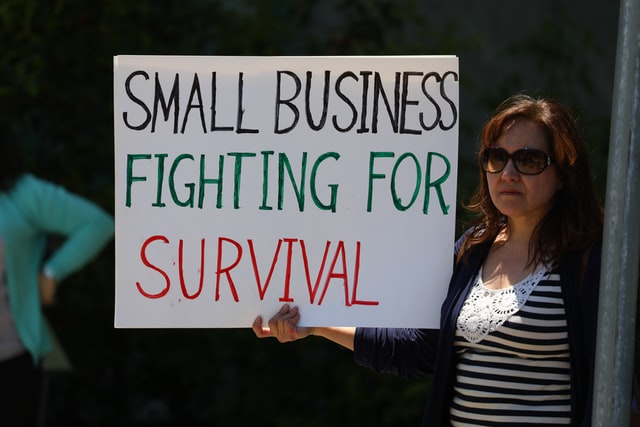

This special edition of the OAS Information Bulletin on MSMEs provides a first inventory of the measures recently announced by OAS member states to mitigate the economic impact of the COVID-19 pandemic on small businesses and aims to foster the resilience of micro, small and medium-sized enterprises (MIPYMES). Small business rates relief policy responses vary from country to country and are specific to the economic and public health contexts of each Member State. Because new developments occur every day, this first inventory is by no means exhaustive.

MSMEs represent more than 95% of all production units in the Hemisphere and more than two-thirds of all jobs. The pandemic is affecting them both on the supply side (such as the reduction in the number of workers due to lockdown and quarantines and supply chain disruptions) and on the demand side (loss of demand for their products and services). It is important to note that small businesses in sectors such as tourism and transportation have been significantly affected by COVID-19 and the measures taken to contain it.

Table of Contents

Political responses have taken different forms

Some countries have announced measures aimed at helping all businesses, while others will implement specific measures for MSMEs. Several OAS member states have focused on financial instruments such as tax breaks, guarantees, and grants. Several commercial banks are offering credit and relief conditions for loan repayments.

In other regions of the world, some countries have suspended penalties for late payments on government contracts (France and Belgium), while other countries have launched new mentoring programs for SMEs (Australia), new instruments to help small businesses rates relief to find new markets (Belgium) and digitization programs (Korea) to help MSMEs open their businesses online.

Countries

Old and bearded

The utility company agreed to suspend all water and electricity disconnections to homes for a period of three months. During the months of April, May, and June, the cost of electricity will be reduced by 20 percent for households.

https://antiguaobserver.com/apua-govt-to-provide-economic-relief-for-residents/

Argentina

Banks are opening specific lines of credit to face the difficulties that companies must overcome due to the impact of the coronavirus pandemic on labor dynamics and specific activities.

Bahamas

The Bahamas Chamber of Commerce and Employers’ Confederation (BCCEC) indicates that initial fiscal measures introduced by the government to support the Bahamian workforce during the COVID-19 pandemic will help “close the gap.”

COVID-19 relief package will “bridge the gap”, says Chamber confederation

Barbados

The Barbados government announced a $ 20 million “survival” stimulus package to provide critical assistance to thousands of individuals and small businesses rate relief in light of the expected calamity of the coronavirus crisis.

The Government announced, among other measures, the immediate establishment of a Family Survival Program to help more than 1,500 vulnerable families.

https://www.stlucianewsonline.com/coronavirus-barbados-announces-20m-survival-stimulus-package-landlords-told-not-to-evict/

The Government of Barbados announced that, through the Barbados Bankers Association, there will be a six-month moratorium on all existing loans and mortgages for individuals and businesses directly affected by the virus.

https://www.barbadosadvocate.com/business/business-monday-policies-expected-protect-householders-businesses

The Barbados government has announced 48 items to be included in the new COVID-19 basket of goods to ensure they are protected against price increases or shortages. The COVID-19 basket of goods represents “what the average homeowner would consume during this crisis.”

http://www.loopnewsbarbados.com/content/barbados-government-announces-covid-19-basket-goods

Be lice

The Government has presented its plans to support people who have recently lost their jobs and the unemployed in general. Commercial banks and credit unions will support businesses and freelancers. Service providers will also provide support.

Bolivia

Senate enacts a law that postpones loan payments for up to 6 months after the emergency. The law defers the payment of credits, capital, and interest up to six months after lifting the health emergency. It also determines to forgive 50% of the payment of bills for basic services.

http://www.la-razon.com/nacional/Senado-sanciona-creditos-facturas-servicios_0_3338066212.html

Brazil

The São Paulo State Research Support Foundation (Fapesp) announced two calls for proposals worth R $ 30 million to direct research initiatives to combat the new coronavirus (SARS-Cov-2), which causes COVID- 19. The objective is to encourage micro and small companies to develop projects that result in technological innovations aimed at the diagnosis and treatment of patients.

Canada

Canada introduced a comprehensive emergency aid package aimed at helping Canadian workers and businesses survive the severe economic recession caused by the new coronavirus pandemic.

The stimulus package, which includes CAN $ 27 billion in emergency aid for workers and businesses and CAN $ 55 billion in tax-deferred taxes, will inject billions of dollars into businesses to help with their cash flow and support workers on the payroll, even if they have been sent home, further strengthens federal benefits and support programs for people who have lost their jobs.

The Bank of Montreal and Export Development Canada announce financial assistance measures for small and medium-sized businesses.

One of Canada’s largest banks and the country’s export credit agency are rolling out targeted aid for small and medium-sized businesses amid growing calls for help to cope with the escalating economic consequences of the new coronavirus.

The Bank of Montreal is offering to increase operating lines of credit for small businesses rates relief and advance funds to help ensure employers are able to pay wages. It also promises to defer loan payments, credit cards, and lines of credit for Canadian small businesses, while offering “personalized relief” similar to that received by larger business clients that could include access to additional working capital. Medium-sized companies are offered individual advice on options to maintain their liquidity.

Export Development Canada said it will support exporters by guaranteeing their bank loans of up to CAN $ 5 million, ensuring that companies “can access more cash immediately.” And for credit insurance customers, EDC will cover losses for goods shipped even if the buyer has not accepted them, subject to some terms, and will waive the claim waiting period.

BMO, Export Development Canada announce financial relief measures for small- and medium-sized businesses

The Government of Canada’s response to COVID-19 includes support for workers, considerations for businesses navigating COVID-19 disruptions, an Economic Response Plan, and guidance for federal employees.

https://www.canada.ca/en/public-health/services/diseases/coronavirus-disease-covid-19.html

Chile

Chile announces an emergency economic plan to face the effects of coronavirus in the country. The plan has three main focuses: job protection, liquidity injection to companies, and support for the most vulnerable Chileans. These measures include the anticipation of the tax refund that corresponds to SMEs and the postponement until July 2020 of the Income Operation.

Likewise, for small and medium-sized companies, starting in April, the State will pay all outstanding invoices.

¿Cómo funcionará el plan económico de emergencia para enfrentar los efectos del coronavirus?

ProChile, the Chilean export promotion office supports exporters during the Covid-19 pandemic. ProChile has been increasing its efforts to support trade between Chile and the United States amid the COVID-19 pandemic.

Colombia

Government announces a package of measures in order to face the effects of the coronavirus on the Colombian economy. People and companies that have difficulties with their credits, will be allowed to suspend the payment of two installments (of two months), with the possibility of refinancing their loans without affecting their credit history. Additionally, a line of credit will be given so that companies can guarantee the payment of their payroll, and the supply of the country’s municipalities and cities will be ensured.

Costa Rica

The Government of Costa Rica proposes to establish a temporary tax moratorium due to coronavirus.

A three-month moratorium on the payment of value-added taxes (VAT), company income and customs duties are some of the financial measures that the government will seek to apply in Costa Rica in the face of the economic effects of the coronavirus.

A significant reduction in the monetary policy rate will also be sought to make loans cheaper and insurance so that the tourism sector can face quarantines due to COVID-19.

Dominica

The National Bank of Dominica Ltd. will offer the following financial assistance programs:

Moratorium on repayment of principal and interest for all interested loan clients for a period of up to six months

The waiver of late fees on all loans and late and limit fees on credit cards for six months beginning April 1, 2020.

Business clients are encouraged to speak with the bank about supporting cash flow or other financial needs for small businesses rate relief.

Relief Programme for Customers in Response to Corona Virus (COVID-19) Pandemic

Ecuador

The Chamber of Small and Medium Enterprises of Pichincha (Capeipi) presented to the President of Ecuador a series of proposals to mitigate the effects of the stoppage of activities and thus avoid bankruptcy of small and medium-sized enterprises (SMEs).

Measures were proposed in commercial, financial, and other policy areas. Among them, promoting and strengthening the production and consumption of Ecuadorian products, as well as guaranteeing the supply of the internal demand for food by national products.

https://www.elcomercio.com/actualidad/capeipi-acciones-gobierno-proteccion-pymes.html

The Savior

The Government of El Salvador approves resources to implement a “liquidity fund for micro, small and medium-sized companies affected by the emergency to finance agricultural producers of basic grains and national coffee: for a subsidy program for the payment of employee payroll that is affected by the declaration of National Emergency and national quarantine and its effects ”.

https://www.elsalvador.com/noticias/nacional/coronavirus-asamblea/700002/2020/

USA

US Small Business Administration (SBA): Coronavirus (COVID-19) – Small Business rates relief Guide and Loan Information:

https://www.sba.gov/page/coronavirus-covid-19-small-business-guidance-loan-resources

Los Angeles announced an emergency loan program to put $ 5,000 to $ 20,000 in the hands of homeowners in just a few weeks.

The $ 11 million loan fund is expected to serve 550 to 2,500 businesses, depending on applications received. Applicants must have at least one employee and in the retail sector, they can have up to 500. Loans are without and with interest. They have no application fee. However, applicants must meet the basic criteria to qualify.

The United States has approved a stimulus package. The law provides clear guidelines on which small businesses are eligible.

The total amount of money that goes into the fund is US $ 349 billion. The loans are federally guaranteed (which means there is no interest on the loan) and are tax-free. All loan payments are deferred for one year.

Any business with fewer than 500 employees is eligible for the loan. All states and territories are eligible. Freelancers, independent contractors, and sole proprietorships are also eligible.

Priority will be given to businesses in rural and underserved markets, including veterans and members of the military community, women, the socially and economically disadvantaged, and businesses that are less than two years old.

Granada

The Government of Grenada announced a series of economic and other measures aimed at helping the island limit the spread of the coronavirus (COVID-19).

http://pridenews.ca/2020/03/21/grenada-government-announces-new-measures-deal-covid-19/

Guatemala

Presidency presents Economic Reactivation Plan to face the coronavirus in Guatemala. It is a plan whose main objective is to preserve economic confidence to promote employment through investment incentives.

Guyana

Republic Bank Guyana lowers interest rates and defers loan payments. In response to the anticipated impact as a result of the COVID-19 pandemic, Republic Bank recognizes that there is a collective responsibility to ensure the sustainability of the business community, employees, and customers.

Haiti

The government reveals its social support plan. This is a program that is part of the social support plan implemented by the government, after the health emergency declared in the country, due to the spread of the coronavirus.

The Ministry of Commerce and Industry wants to fight against the black market that aims to increase the prices of certain foods and even pharmaceutical products, especially those intended for hand washing.

Honduras

President announces economic measures to support companies so that they will not lay off employees and close due to the emergency. Among the economic measures that the government has announced is the readjustment of loan installments with the Honduran Bank for Production and Housing (Banhprovi). Likewise, Crédito Solidario will support 5,000 entrepreneurs.

Jamaica

The Government has instituted a US $ 5.9 billion COVID Resource Allocation Program for Employees (CARE) to assist tourism businesses and workers during the period of emergency caused by the coronavirus (COVID-19).

The Minister of Finance describes the government’s financial rescue package for thousands of Jamaican workers and small operators in the area of tourism and other related sectors that have been affected by a recession in activities due to the COVID-19 pandemic.

http://www.jamaicaobserver.com/news/COVID-19_BAILOUT?profile=1373

Members of Jamaica’s small business and hotel sectors have reacted with relief to the government’s announcement of an assistance package for some of its members in response to the effects of the coronavirus – COVID-19.

http://rjrnewsonline.com/local/governments-financial-support-for-small-enterprises-workers-welcomed

Some financial institutions in their response to provide support to customers, especially those most affected by the impacts of the new coronavirus (COVID-19), have prepared specialized measures to cushion the possible effects.

Mexico

The president of Mexico will grant loans without interest or at low rates to one million small businesses to counteract the effects that the Covid-19 coronavirus will leave in the country.

https://www.milenio.com/negocios/coronavirus-covid-19-amlo-dara-credito-pymes

As part of the economic containment plan for health contingency due to coronavirus in Mexico City, the capital government will enable 50,000 microcredits for small businesses with 0 interest rate, 4 months of grace to pay, and 2-year deposits.

https://bajopalabra.com.mx/cdmx-ofrece-50000-microcreditos-a-pymes-por-crisis-de-covid-19

Nicaragua

The Nicaraguan Council of Micro, Small, and Medium Enterprises (Conimipyme) proposed this Monday to the Government of Nicaragua to control for three months the prices of the basic food basket and of pharmaceutical and hygiene products linked to the prevention of the coronavirus pandemic. The Nicaraguan financial system was also asked to reduce interest rates on loans and suspend payment on credit cards for two months.

Panama

In Panama, the National Government adopts measures aimed at strengthening the economic and financial capacities of companies and individuals. One of these measures is the extension for an additional year of the tax exemption that applies to micro, small and medium-sized companies that are duly registered with the Micro, Small, and Medium-sized Companies Authority (AMPYME). On the other hand, the deadlines for filing income tax reports will be extended.

Paraguay

Paraguayan Senate approves small business rete relief emergency bill for coronavirus.

Senado paraguayo aprueba proyecto de emergencia por coronavirus

Peru

The Peruvian government reported that it will publish an emergency decree where it will small business rates relief create a business fund of up to 30 thousand soles to support micro, small and medium-sized enterprises (MiPymes) that will have an economic impact due to the measures to control COVID-19 in Peru.

Dominican Republic

The Central Bank of the Dominican Republic (BCRD) will allocate RD $ 10 billion to loans to households, micro, small and medium-sized companies, and the commerce sector in order to meet the demand of the productive sectors and Dominican households in the face of the spread of COVID-19.

St. Kitts y Nevis

COVID-19: The government’s 17-point stimulus package includes business and business tax cuts. The government will reduce the corporate income tax and the unincorporated business tax. There will be a reduction of the Corporate Income Tax rate from 33% to 25% for the period from April to June 2020 for companies that retain at least 75% of their employees. The government stimulus package also includes deferring the payment of Property Tax from June to September 2020; the elimination of Value Added Tax (VAT) and Import Tax for six months on hygiene items such as hand sanitizers, hand sanitizer dispensing machines, disinfectant wipes, alcohol, gloves, masks, and protective gowns,

COVID-19: Government’s 17-Point Stimulus Package Includes Reducing Corporate and Business Tax

Saint Lucia

The residents of Saint Lucia will get a deferral of their principal and interest payments for at least six months as the government seeks to respond to the small business rates relief coronavirus crisis on the island.

https://www.stlucianewsonline.com/saint-lucians-to-get-loan-payment-reprieve/

St. Vincent and the Grenadines

The Prime Minister will outline the additional plans his administration has to deal with the impact of COVID-19 in Saint Vincent and the Grenadines.

Suriname

SRD 5 million has been pledged for an interim COVID-19 related budget for health services.

https://www.imf.org/en/Topics/imf-and-covid19/Policy-Responses-to-COVID-19#S

Trinidad and Tobago

Trinidad announces a series of measures to help alleviate the impact of the coronavirus.

The government of Trinidad and Tobago announced a multi-million dollar package to address the economic impact of the coronavirus (COVID-19).

Uruguay

In Uruguay, the funds of the National Guarantee System for the SIGA Pyme line are increased, making it possible for small business rates relief to grant loans to SMEs for up to US $ 2,500 million. In addition, 70% of the commission charged by the guarantee system is exonerated.

Small business rates relief To give liquidity to SMEs, ANDE’s directed Credit Program will add as beneficiaries micro and small companies affected by the health emergency for loans destined for working capital. The interest rate that microfinance institutions charge for loans to micro and small businesses will be subsidized.

Regions

CARICOM (Caribbean and Belize)

Sagicor Bank is committed to helping clients amid the COVID-19 outbreak.

http://www.loopjamaica.com/content/sagicor-bank-commits-assisting-clients-amidst-covid-19-outbreak

International organizations

Inter-American Development Bank (IDB)

The Inter-American Development Bank and IDB Invest published their approach to deploying the financial and technical resources made available to borrowing member countries and companies to address the crisis created by COVID-19, the disease caused by the coronavirus.

The immediate public health response; Safety nets for vulnerable populations; Measures to protect the income of the most affected populations; Economic productivity and employment; and Fiscal policies to improve economic impacts small business rates relief.

https://www.iadb.org/en/news/idb-group-announces-priority-support-areas-countries-affected-covid-19

The IDB will help SMEs cope with the consequences of COVID-19. The Inter-American Development Bank (IDB) will facilitate access to small business rates relief remote work technologies for small and medium-sized enterprises (SMEs) in Latin America and the Caribbean so that the region can face the coronavirus (COVID-19).

http://www.jamaicaobserver.com/latestnews/IDB_to_assist_SMEs_cope_with_fallout_from_COVID-19

IDB partners with Transparent Business to facilitate remote access technologies for SMEs.

World Bank

The World Bank Group increases the COVID-19 response to $ 14 billion to help sustain economies and protect jobs. The measures include the US $ 6 billion by IFC to help provide a lifeline to micro, small and medium-sized enterprises, small business rates relief which are most vulnerable to economic shocks.

Organization for Economic Cooperation and Development (OECD)

COVID-19: SME Policy Responses

IMF Policy Tracker by Country

https://www.imf.org/en/Topics/imf-and-covid19/Policy-Responses-to-COVID-19#S/

Leave a Reply